The Patient Protection and Affordable Care Act, also known as the “Affordable Care Act” or “ACA”, was passed by Congress and signed into law by President Obama on March 23, 2010. The ACA was put in place to increase access to quality health coverage, lower health care costs, enhance the quality of care for all Americans and insure 30-70 million Americans who are uninsured. In June 2012, the Supreme Court upheld the ACA after considering a series of challenges to several of the law’s key provisions. The major reforms in the ACA became effective in 2014.

The ACA is changing the healthcare industry. We’re here to help you make sense of what these changes mean for you. Here are the 10 key terms and topics you should know:

- Guaranteed Issue

- Federal Subsidies and Tax Credits

- MAGI

- New Marketplaces/Exchanges

- Open Enrollment

- Penalties

- Qualified Health Plans & Essential Health Benefits

- Metal Level Plans

Guaranteed Issue

As of January 1, 2014, health insurance issuers must accept every individual in the state that applies for coverage regardless of health, age, gender, or other factors (including pre-existing conditions).

Federal Subsidies and Tax Credits

Starting in 2014, subsidies are available for consumers whose annual income is between 134% and 400% of the Federal Poverty Level (FPL) and who meet other applicable guidelines. These cost-sharing reductions and advanced premium tax credits will lower the cost of premiums and out-of-pocket expenses for health coverage purchased through State/Federal Exchanges. Those with an FPL under 134% may be eligible for Medicaid.

Tax credits are also available to small businesses with no more than 25 full-time equivalent employees to help offset the cost of providing coverage. Beginning January 1, 2014, this provision provides a credit worth up to 50% percent of the employer's contribution to the employees' healthcare coverage, including contributions for medical, dental, and vision. If you understand how the subsidies and tax penalties work, you’ll be in a better position to purchase the health plan that suits you best.

Qualifying for subsidies

The ACA determines whether or not you’re eligible for subsidies based on the following criteria:

- You/your family members live in the United States of America.

- You/your family members are U.S. citizens, U.S. nationals, or otherwise lawfully present in the United States.

- You/your family members are not incarcerated.

- Your combined total household income is between 133% and 400% of the Federal Poverty Level (FPL). People with incomes below 133% of FPL will qualify for Medicaid in most states.

- Please NOTE: The March 2021 COVID-19 relief legislation, the American Rescue Plan Act (ARPA), extends eligibility for ACA health insurance subsidies to people buying their own health coverage on the Marketplace who have incomes over 400% of poverty, up to 600% of poverty. The law also increases the amount of financial assistance for people at lower incomes who were already eligible under the ACA. Both provisions are temporary, and while they were extended through 2025, they are not intended to be permanent. Normally, an income above 400% of the poverty level would make a household ineligible for premium subsidies. But from 2021 through 2025 premium subsidies are available above that level if they’re necessary in order to keep the cost of the benchmark plan at no more than 8.5% of the household’s ACA-specific MAGI.

In order to receive either a Federal subsidy or tax credit, you must purchase your health insurance policy through your state’s Exchange.

CRITICAL ISSUES REGARDING INCOME CALCULATION AND SUBSIDY QUALIFICATION

- If you qualify for Medicaid but choose NOT to enroll in Medicaid, you will not qualify for any Federal subsidy through the state’s exchange.

- If your household income is above 137% of the FPL but below 200 - 300% of the FPL (depends on your state: CA, below 250%; OR, below 300%) and you have children, your children will automatically be enrolled in CHIP. CHIP provides low-cost health coverage to children in families that earn too much money to qualify for Medicaid. In some states, CHIP covers parents and pregnant women. Each state offers CHIP coverage, and works closely with its state Medicaid program. If your children are automatically enrolled in CHIP, you still need to include them in the number of total members of your household when entering your income in the Exchange calculator to determine whether you qualify for a Federal subsidy or not. Like #1, above, if you choose not to enroll your children in your state’s CHIP program, you forfeit your subsidy and there’s no reason to purchase your insurance through your state’s exchange.

- If your estimate of household income is low by more than 10%, you will pay the difference between your subsidized health insurance premiums and the actual premium based on your corrected income, when you pay your income taxes each April of the following year.

- If you have group-based coverage available to you and your dependents, you cannot receive a Federal subsidy even if you qualify for one. In this case, it is better to purchase coverage outside of the exchange or enroll yourself/family members in your group plan.

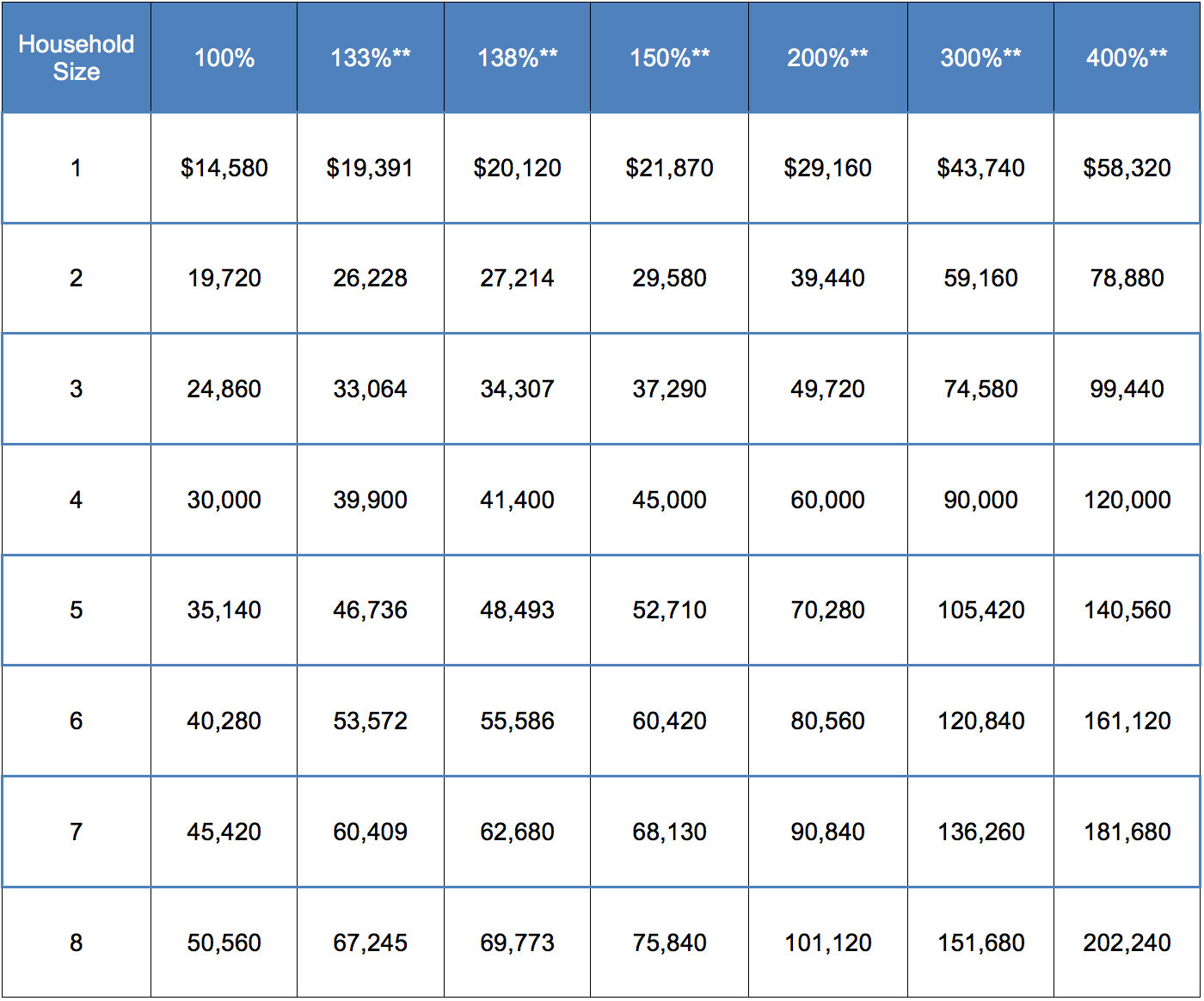

2023 Federal Poverty Guidelines

The Department of Health & Human Services (HHS) issues poverty guidelines that are often referred to as the “federal poverty level” (FPL). The Marketplace will continue to use the 2023 guidelines when making calculations for advance payments of premium tax credit (APTC) and income-based CSRs through at least early 2024.

2023 Poverty Level Chart*

* Chart is for 48 contiguous states and the District of Columbia.

** Dollar amounts are calculated based on the 100% column; rounding rules may vary across federal, state, and local programs.

Note: The 100% column shows the federal poverty level for each family size, and the percentage columns that follow represent income levels that will be used for 2023 cost assistance/subsidy determination and taxes filed April 15, 2024.

MAGI

Beginning in 2014, individuals who purchase health insurance coverage through one of the new health insurance exchanges will be eligible for financial assistance if their income is no more than 400% of the federal poverty line (FPL). MAGI, Modified Adjusted Gross Income (not "Adjusted Gross Income") will be used in determining eligibility for these premium tax subsidies.

Generally, your Adjusted Gross Income (AGI) is your household's income less various adjustments. Adjusted Gross Income is calculated before the itemized or standard deductions, exemptions and credits are taken into account.

Generally, your Modified Adjusted Gross Income (MAGI) is the total of your household's Adjusted Gross Income and any tax-exempt interest income you may have. Taxpayers who receive non-taxable Social Security benefits, earn income living abroad, or earn non-exempt interest should add back that income to AGI to calculate MAGI.

New Marketplaces/Exchanges

The Affordable Care Act (ACA) created new “marketplaces” (also known as “exchanges”) where individuals and small businesses are able to purchase health insurance for coverage beginning in 2014. In order to receive either a Federal subsidy or tax credit, you must purchase your health insurance policy through your state’s Exchange or the Federal Exchange (if your state does not have its own exchange).

In addition to buying coverage via the state and federal exchanges, individuals and small businesses are able to purchase health care through brokers and directly through health insurance carriers. You can choose a broker when purchasing within the Exchange to assist you during the initial application process and throughout the year. There is no incremental cost to you in choosing and using a broker either inside or outside of the Exchange.

Open Enrollment

Individual Open Enrollment

Open-Enrollment for 2024: Enrollment in health plans effective January 1, 2024 will begin on November 1, 2023 and end on January 15, 2024. Applications will generally only be accepted during this open enrollment period. There are exceptions for “special enrollment” within 60 days of a life-changing event, such as the loss of a job, death of a spouse or birth of a child. This is similar to how Open Enrollment periods work for coverage through an employer-based health insurance plan. If you have a Special Enrollment Period you need to submit your application within 60 days of your prior coverage ending AND by the 15th of the month prior to the first of the month you want your new individual coverage to commence.

For 2024, whether on or off the exchange, you must apply by December 15, 2023 in order to have an effective date of January 1, 2024. If you apply between December 16, 2023 and January 15, 2024, you will have a February 1, 2024 effective date. After January 15, 2024, you will need to have a special enrollment period reason in order to apply for individual coverage for March through December, 2024.

Small Business Open Enrollment

Small business employers will have an annual election period prior to the group’s annual open enrollment period. Other than the annual open enrollment period, employees can only enroll or change plans once a year, unless they qualify for a special enrollment period (e.g., loss of other group coverage, permanent move out of state, etc.).

Qualified Health Plans & Essential Health Benefits

Under the ACA, starting in 2014, an insurance plan that is certified by the Health Insurance Marketplace, provides essential health benefits, follows established limits on cost-sharing (like deductibles, copayments, and out-of-pocket maximum amounts), and meets other requirements. A Qualified Health Plan (QHP) will have a certification by each Marketplace in which it is sold. To avoid penalties, you must have a QHP.

All non-grandfathered health plans offered in the individual and small business markets, both inside and outside of the state exchanges, must be QHPs. All QHPs are required to offer a core package of benefits and services known as "Essential Health Benefits," that must include coverage within at least the following 10 categories:

- Ambulatory patient services

- Prescription drugs

- Emergency services

- Rehabilitative and habilitative services and devices

- Hospitalization

- Laboratory services

- Maternity and newborn care

- Preventive and wellness services and chronic disease management

- Mental health and substance use disorder services, including behavioral health treatment

- Pediatric services, including oral and vision care

Metal Level Plans

Under the Affordable Care Act, all non-grandfathered health plans offered in the individual and small business markets, both inside and outside of state Exchanges, will be required to provide coverage at a "metal level" – Platinum, Gold, Silver and Bronze. The metal levels are based on the actuarial value (AV) as follows: Bronze (60 percent AV), Silver (70 percent AV), Gold (80 percent AV) or Platinum (90 percent AV). This means that someone who buys a silver plan would have to pay 30 percent of health care costs, while the plan covers 70 percent.

There is also a Catastrophic plan (for the individual market only) that will cover the essential health benefits plus three primary-care doctor visits per year. The Catastrophic plan can only be sold to consumers under age 30 and consumers who are exempt from the individual mandate as a result of low income or hardship.

There are more plans offered outside of the exchange than inside the exchange. If you do not qualify for a subsidy, there is no reason to go through your State/Federal Exchange as the application process is more cumbersome and time consuming. Nearly all plans available inside the exchange are also available outside of the exchange. Moreover, there are additional plans available outside of the exchange, expanding your choices and options for coverage in the coming year.

This web site may contain concepts that have legal, accounting and tax implications. It is not intended to provide legal, accounting or tax advice. You may wish to consult a competent attorney, tax advisor, or accountant.