Medicare

Medicare is a confusing subject for almost everyone. For most Americans, eligibility for Medicare is the first -- and last -- time they will have to make a decision about their health insurance plan. As you approach this critical decision you'll want the most competent, reliable and sensitive advisor to assist you. We take the time to clarify the confusing terms, explain how Medicare works, and how it differs from your current coverage.

What is Medicare?

Medicare was established in 1965 and is a U.S. Government Administered Health insurance Program for:

- Americans age 65 and older

- Americans under age 65 with certain disabilities

- Americans of all ages with kidney failure requiring dialysis or a transplant

Medicare has four parts

- Part A – Hospital Insurance

- Part B – Medical Insurance

- Part C – Medicare Advantage Plans

- Part D – Prescription Drug Plan

Part A helps cover inpatient care in hospitals, skilled nursing facilities, hospice, and home health care. Most people have paid for their Part A by the time they are Medicare eligible by virtue of payroll taxes over ten years (40 quarters) of working in the U.S. There are some gaps in Part A coverage including a deductible that will need to be covered by either a Medigap plan or a Medicare Advantage plan.

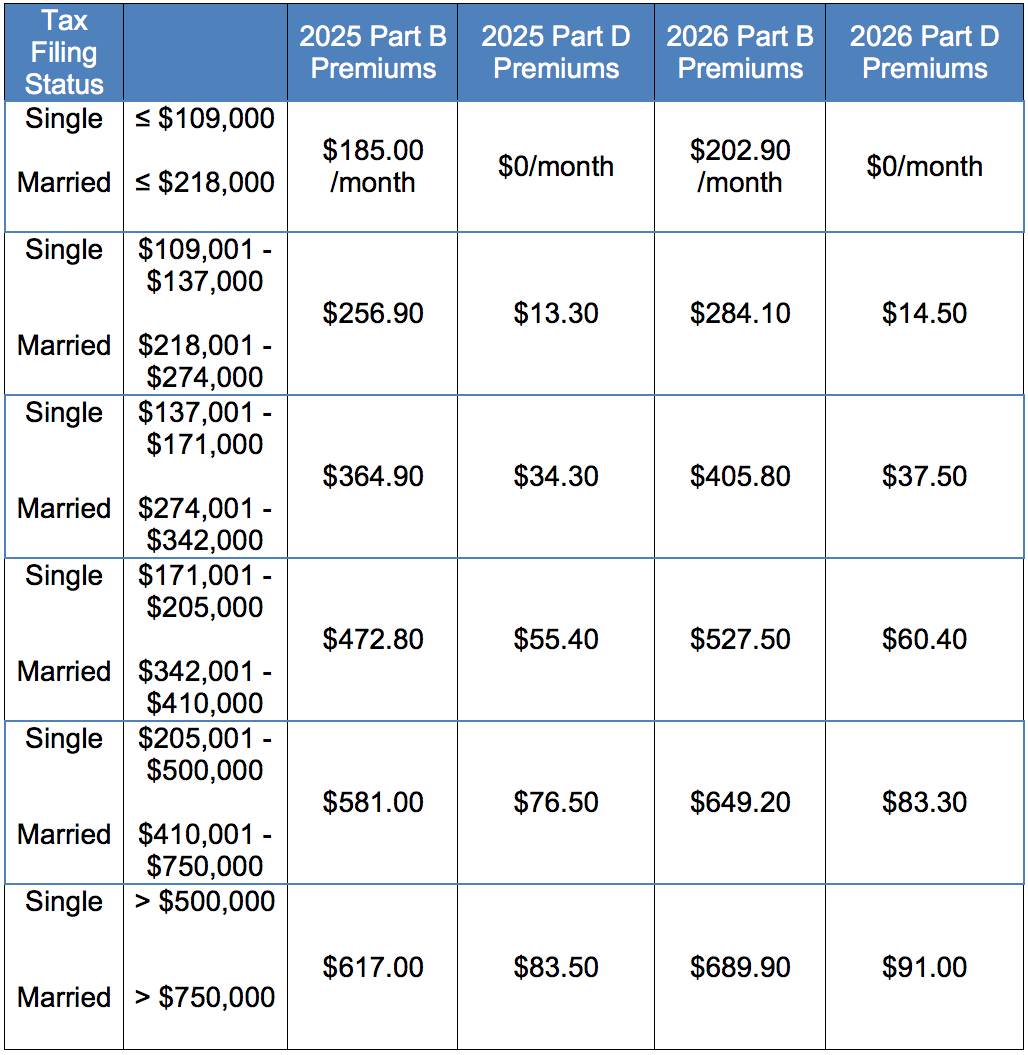

Part B helps cover doctors’ and other health care providers’ services, hospital outpatient care, durable medical equipment, home health care and many preventive services. Specifically, Medicare Part B covers 80% of outpatient services including the cost of the surgeon performing surgery in a hospital. The standard cost of Part B is $206.50 in 2026. If your 2024 income (2026 rate for Medicare Part B is based on your 2024 income) is more than $109,000 filing separately or $218,000 filing jointly, you will pay more for Part B. For more information, see IRMAA Table below.

Part C plans are also called “Medicare Advantage” plans. This is an alternative to a Medicare Supplement or “Medigap” plan. You need one or the other in order to fill in the gaps of Medicare Parts A and B. There are costs and benefits to each type of plan.

Part D covers prescriptions drugs. If you purchase a Medigap plan and want coverage for medications, you need to purchase a separate prescription drug plan (PDP). If your 2024 income (2026 rate for Medicare Part D is based on your 2024 income) is more than $109,000 filing separately or $218,000 filing jointly, you will pay more for Part D directly from your Social Security check, or, if you do not yet receive Social Security, you will pay the Social Security Administration directly, every calendar quarter. For more information, see the IRMAA Table below.

There are many plan options for PDP plans in your area. To determine the PDP plan that best meets your needs, go to www.medicare.gov and click on the prescription link. You will enter each of your medications and be presented with the available plans and prices. Carlton Insurance can help you if you need assistance. If you purchase a Medicare Advantage plan, you will have the option to have an integrated PDP plan. You cannot pair an MA plan with a separate Part D plan, by law. You are not required to purchase a Part D plan. If you choose not to have a Part D/Rx plan there are some minor penalties you will incur if you choose to buy a plan in a future year.

Timing

Most Americans become eligible for Medicare the first of the month they turn 65. If you were born on the first day of a month, you will be eligible for Medicare the first of the month prior to your 65th birthday. There are other situations where people are eligible (disability prior to age 65, kidney dialysis patients, etc.).

The easiest way to apply for Medicare is directly at www.medicare.gov. You can also visit your local social security office in person.

Once you have either received your Medicare ID card in the mail or received a message from the Social Security Administration with your Medicare ID number (“Medicare claim number”) and your eligibility date for both Medicare Part A and Medicare Part B, you are ready to consider your options for either a Medigap Plan or a Medicare Advantage Plan (also known as an MA plan or an MAPD plan). If you are pairing a Medigap Plan with a Part D/Rx plan, you can proceed with your prescription plan decision as well.

If you only want a Part D/Prescription plan (a PDP plan), you only need to be eligible for either Part A or Part B of Medicare.

Open Enrollment

For MA, MAPD and PDP plans only there is an Open Enrollment period each year from October 15 to December 7. During this time each year you will be able to change your plan for the following January. There are a few special enrollment periods during the year that can also arise if you move out of your area, lose group coverage, etc.

For Medigap plans, there is no specified enrollment period. However, there are a few timing issues that can impact your ability to qualify for a Medigap plan:

- During the first six month period of your Medicare Part B eligibility, you have a “guaranteed issue right” when you cannot be declined coverage due to your medical history.

- During the first 12 month period of your Medicare Part B eligibility, you have a “trial period” where in you can change from a Medicare Advantage plan to Medigap plan one time only without regard to your medical history.

- Outside of the “guaranteed issue right” and “trial period” you will need to disclose your medical history and risk being declined coverage for a Medigap plan.

- In some states (OR, CA) there is a birthday rule allowing you to change from a like plan to another like plan during the month of your birth that constitutes an additional “guaranteed issue right”. This is often a way to maintain the same level of coverage over time but reduce your premium.

Income Related Monthly Adjustments Amount (IRMAA) Calculations

If your 2024 Adjusted Gross Income (AGI) exceeded $109,000 filing single or $218,000 filing jointly, you will pay an “income related monthly adjustment amount” (IRMAA) beyond the standard amount for Part B of Medicare. The IRMAA Tables are updated annually. New rates, effective January 1, 2026, are in the table below.

If you have a Part D plan, either a stand alone Part D plan or a Part D plan embedded with your Medicare Advantage plan, you will pay IRMAA for Part D as well. If you already receive Social Security, Part B premiums and any IRMAA will automatically be deducted from your monthly Social Security check. If you do not yet receive Social Security, you will pay a quarterly invoice to Social Security to cover the Part B premium and any IRMAA for both Part B and Part D.

The following table provides the IRMAA details for 2026 (based on 2024 income):

IRMMA APPEAL

If your income two years ago was higher because you were working at that time and now your income is significantly lower because you retired (“work reduction” or “work stoppage”), you can appeal the IRMAA assessment. The “life-changing events” that make you eligible for an appeal include:

- Death of a spouse

- Marriage

- Divorce or annulment

- Work reduction

- Work stoppage

- Loss of income from income producing property

- Loss or reduction of certain kinds of pension income..

Medigap or Medicare Advantage?

There are many insurance companies selling both Medigap plans and Medicare Advantage plans. There are advantages and disadvantages to both types of plans. Each individual needs to assess his or her priorities for coverage, provider networks, premiums and annual out of pocket costs in order to determine the best fit.

Medigap Plans

A Medigap policy is health insurance sold by private insurance companies to fill gaps in Original Medicare, the combination of Part A and Part B. Medigap policies help pay your share (coinsurance, copayments, or deductibles) of the costs of Medicare-covered services. Some Medigap policies also cover certain benefits Original Medicare doesn’t cover, for example, some foreign travel medical expenses.

A “Medicare Supplement Insurance” policy (also called Medigap) is health insurance sold by private insurance companies to fill the gaps in Original Medicare coverage. It is designed to supplement Original Medicare. This means it helps pay some of the health care costs that Original Medicare doesn’t cover (like copayments, coinsurance, and deductibles). These are "gaps" in Medicare coverage. If you have Original Medicare and a Medigap policy, Medicare will pay its share of the Medicare-approved amounts for covered health care costs. Then your Medigap policy pays its share.

Every Medigap policy must follow Federal and state laws designed to protect you, and the policy must be clearly identified as “Medicare Supplement Insurance.” Medigap insurance companies in most states can only sell you a “standardized” Medigap policy identified by letters A through N. NOTE: Beginning 1/1/2020, anyone who was not already eligible for Medicare Part A cannot purchase either a Plan C or Plan F. Those plans will only be sold to those Medicare recipients who are Medicare eligible prior to 2020. Each standardized Medigap policy must offer the same basic benefits, no matter which insurance company sells it. Cost and customer service are the only differences between Medigap policies with the same letter sold by different insurance companies.

The most popular Medigap plans are Plan F or Plan G. If your Medicare Part A eligibility date is 12/1/19 or earlier, you can enroll in Plan F. If your Medicare Part A eligibility date is 1/1/2020 or later, the best possible standard Medigap Plan will be a Plan G. Plan F supplements will no longer be sold to anyone with a Medicare Part A effective date of 1/1/2020 or beyond. With a Plan F, you pay your monthly premium and have no other out of pocket expenses for covered Medicare Services throughout the year (medical only; prescription drugs are not covered in Medigap plans but rather in Part D plans that can be purchased separately). With a Plan G, you will need to first pay the Part B deductible ($288 in 2026) but expected to rise over time based on the economics of Medicare and the reality that so many will be joining Medicare in the coming years as baby boomers turn 65).

Like all Standard Medicare Supplements, both Plan F and Plan G provide a very broad network of doctors across the U.S. In fact, you can go to any doctor in the country who accepts Medicare patients and bills Medicare directly.

Medicare Advantage Plans

Medicare Advantage Plans are health plans run by Medicare-approved private insurance companies. Medicare Advantage Plans are a way to get the benefits and services covered under Part A and Part B. Most Medicare Advantage Plans cover Medicare prescription drug coverage (Part D). Some Medicare Advantage Plans may include extra benefits for an extra cost.

Medicare Advantage Plans come in two flavors:

- Medicare Advantage (MA) plans do not cover prescription drugs. If you choose an MA plan you are choosing not to have any Rx coverage. You cannot purchase a separate Rx plan, by law, if you have an MA plan.

- Medicare Advantage Prescription Drug (MAPD) plans cover prescription drugs. If you want coverage for prescriptions and choose to have a Medicare Advantage plan, you must purchase an MAPD plan.

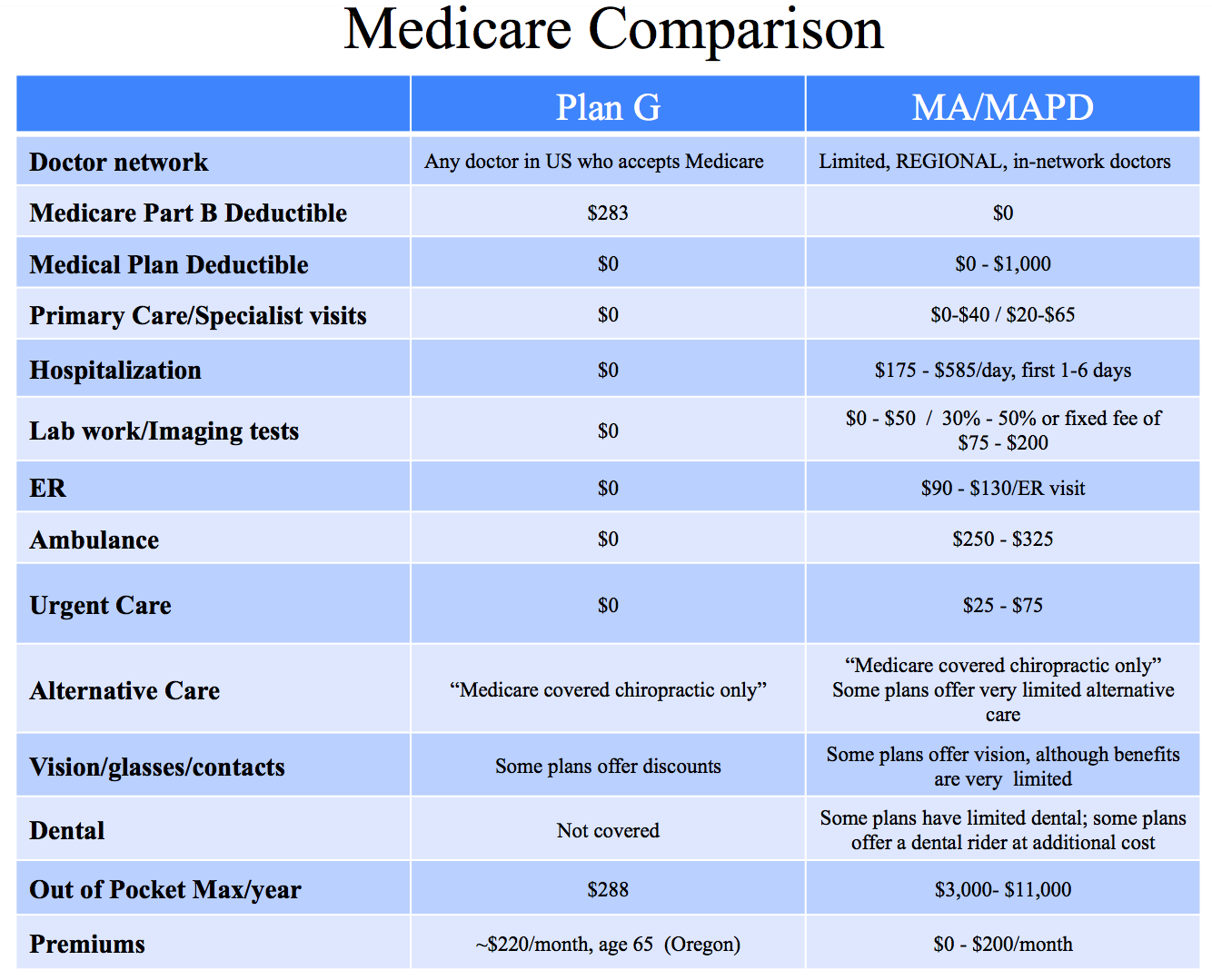

Unlike Medigap plans, MA/MAPD plans have co-pays for doctor visits, hospital stays, lab work, diagnostic services, etc. Each MA/MAPD plan has an established out of pocket maximum that typically ranges from $3,000 - $11,000/calendar year.

Many MA/MAPD plans offer some vision, dental and chiropractic services that Medigap plans do not cover. But beware. The amount of coverage for these “extras” is limited and often not worth the MA/MAPD out of pocket maximum amount that is not part of a Medigap Plan F or G.

Medicare Advantage plans have a closed network of doctors. While most of the literature refers to “out of network” providers, if you see an out of network provider, they not only charge higher rates but will not handle the claims and billing. Out of network providers leave billing matters up to you. At age 65, handling claims and billing is reasonable. At older ages, this can be difficult for you and/or your family.

Furthermore, most Medicare Advantage plans require strict pre-authorization when approving out of network visits to specialists in other states. It is rare that these visits are authorized. Therefore, if you want the freedom to utilize the service of a nationally recognized expert in the event of a future disease, complicated surgery, or unusual injury, you will be better served with a Medigap plan.

The following chart highlights some of the key differences between the Medigap Plan G and Medicare Advantage Plans. If you are eligible for Medicare prior to 2020, you can purchase a Plan F. Note that the only difference between the Plan F and Plan G is the Part B deductible which is covered fully with a Plan F. As a result, the premium is slightly higher with a Plan F compared to a Plan G.

This web site may contain concepts that have legal, accounting and tax implications. It is not intended to provide legal, accounting or tax advice. You may wish to consult a competent attorney, tax advisor, or accountant.