Carlton Insurance LLC represents a wide variety of insurance carriers offering a broad spectrum of products serving individuals & families as well as small businesses. We work with top rated carriers and understand the benefits of each.

If you are a small business owner with a minimum of 2 owners/employees (with at least one non-owner/non-owner spouse on payroll), please contact us to determine whether a small business insurance product would best suit your needs. There are many questions to answer to determine the feasibility of a small business insurance plan and it is easier done on the phone than via a web site. If you are eligible, we can put together a health insurance package that includes life insurance, disability, and even long-term-care.

Catastrophic Plans (major medical)

A catastrophic or major medical plan is aimed at covering a catastrophic injury or illness after you meet a deductible. In fact, these plans typically do not cover any medical expense until a deductible is met. In the plans available across the U.S., catastrophic plans are typically in the Bronze metal category as well as the plan entitled “catastrophic” (available only for those under 30 years of age). Some catastrophic plans are HSA eligible; some are not.

With a catastrophic plan, once you meet the annual deductible, you continue to pay a percentage of the remaining costs (called "co-insurance"), typically 30% or 40% depending on the plan, until you reach an out-of-pocket maximum. In 2026, the maximum out of pocket for a qualified health plan is capped at $10,600/person and $21,200/family per calendar year for in-network services. NOTE: Both deductible and out of pocket maximum amounts are much higher when using out of network providers (if there is any out of network coverage on your plan) so it is critical to stay in network when seeking medical services. These amounts include your annual deductible, as well as your co-pays for prescriptions. Here's an example of how it works:

Your plan design: $3,500 deductible plan, 30% co-insurance, $10,600 out of pocket maximum, for in-network providers.

If you have in-network medical expenses resulting from an illness or injury totaling $50,000, you will pay the first $3,500 and satisfy your annual deductible. Then, you'll pay 30% of the remaining $46,500 until you’ve paid another $7,100 ($3,500 + $7,100 = your out of pocket maximum of $10,600). At that point, your insurance carrier will pay 100% of your medical expenses until January of the following year.

Comprehensive plans

A comprehensive plan includes all of the elements of a catastrophic plan PLUS coverage for other medical services with the deductible waived. For example, a comprehensive plan offers doctor visits for a $10 - $150 co-pay as well as co-pays for prescriptions, with the deductible waved. Comprehensive plans are typically in the Platinum, Gold and Silver metal categories. Some of the plans offer unlimited doctor visits for a co-pay. Other plans have a set number of visits, per person, per year, for a co-pay after which the annual deductible would apply.

HSAs (Health Savings Accounts)

HSA Accounts or HSA plans allow you to save money to pay for future medical expenses on an income tax-free basis. A Health Savings Account is really a combination of a health insurance policy meeting minimum U.S. Treasury policy design requirements called a qualified High Deductible Health Plan (HDHP) and a separate custodial savings account for future medical expenses called a Health Savings Account. The qualified HDHP provides comprehensive coverage for serious illness and injury at a more affordable premium rate.

An HSA is a tax-exempt account in which you accumulate savings to pay medical expenses that would apply to your deductible or are otherwise not covered by your plan (e.g., dental, orthodontia, hearing aids). An HSA allows you to enjoy unique tax benefits and affordable health premiums without risking your financial protection. HSAs offer a way to set aside funds to pay for medical expenses for today and tomorrow. HSAs provide you with tax savings when you contribute the funds and when you use the funds.

Annual contributions to the HSA bank account reduce your taxable income and funds used for qualified medical expenses are never taxed. All of the money you set aside plus the invested earnings in your HSA grows tax-deferred. At age 65, you can withdraw funds for any non-medical purpose at ordinary tax rates, or tax-free when used for qualified medical expenses. Funds in an HSA account can be used to pay for medical expenses incurred in meeting the deductible, any required shared expenses for which you are responsible, and qualified medical expenses not covered by the health insurance plan such as vision and dental expenses. Click here for a list of eligible medical expenses, as summarized by HSA Bank. This is a partial list of eligible medical expenses. You are encouraged to view the IRS's website (Publication 502) for a complete list of eligible medical expenses.

The ideal candidate for an HSA qualified health plan is someone who needs a tax deduction. If you do not need a tax deduction, there may be a more affordable catastrophic plan that will better meet your needs and your budget.

In the plans available across the U.S., HSA plans are typically in the Bronze metal category.

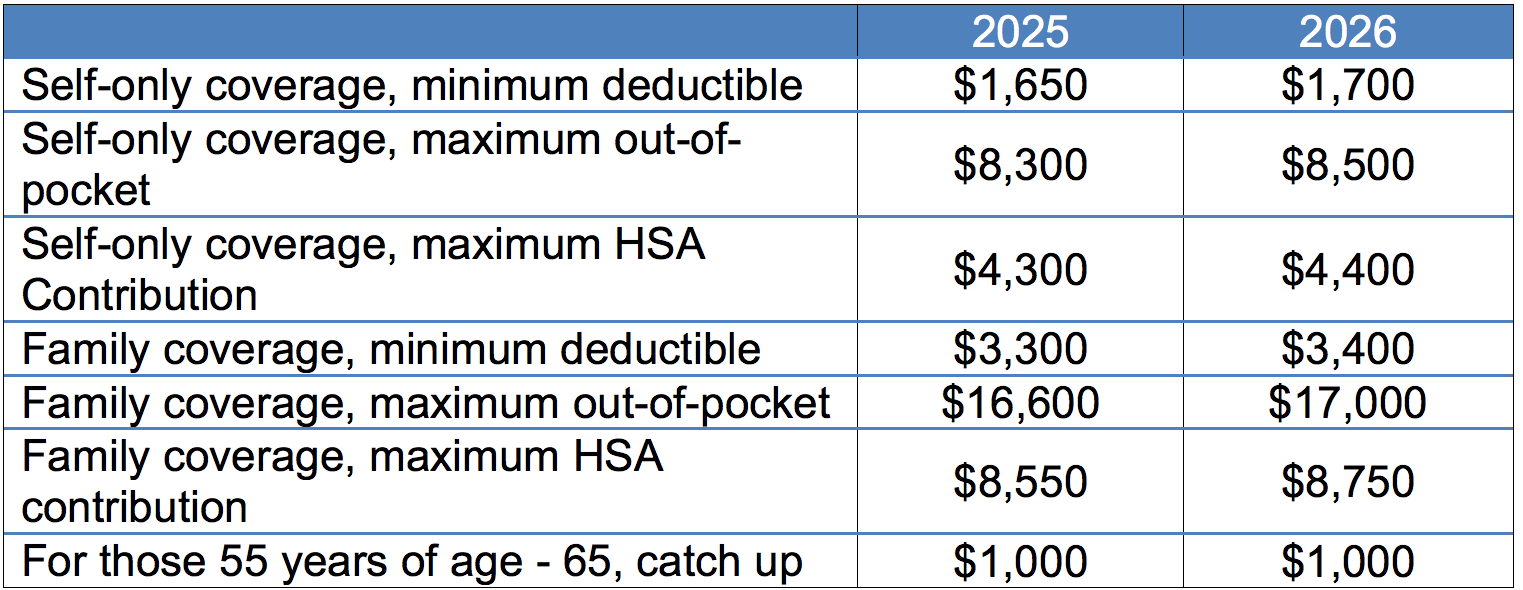

Health Savings Accounts - 2025 & 2026 HSA Cost-of-Living Adjustments

HSA individual High Deductible Health Plan (HDHP) Requirements

If you already have an HSA health insurance policy and would like to open an HSA bank account, you can go to Fidelity Bank online to make the process simple & quick and save some bank fees. Just click here!

Click here for information on Life, Disability, Long-Term-Care and Medicare Supplements

This web site may contain concepts that have legal, accounting and tax implications. It is not intended to provide legal, accounting or tax advice. You may wish to consult a competent attorney, tax advisor, or accountant.